Inflation in zimbabwe in 2008 quizlet

Data: 2.09.2018 / Rating: 4.6 / Views: 941Gallery of Video:

Gallery of Images:

Inflation in zimbabwe in 2008 quizlet

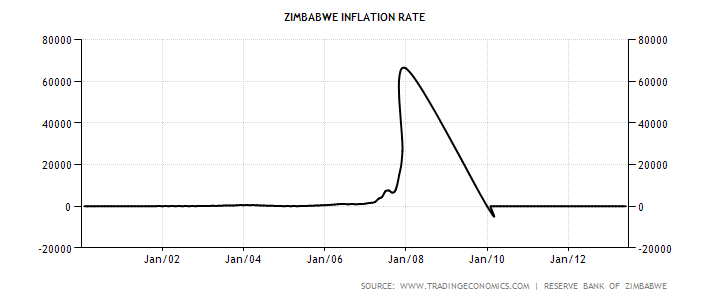

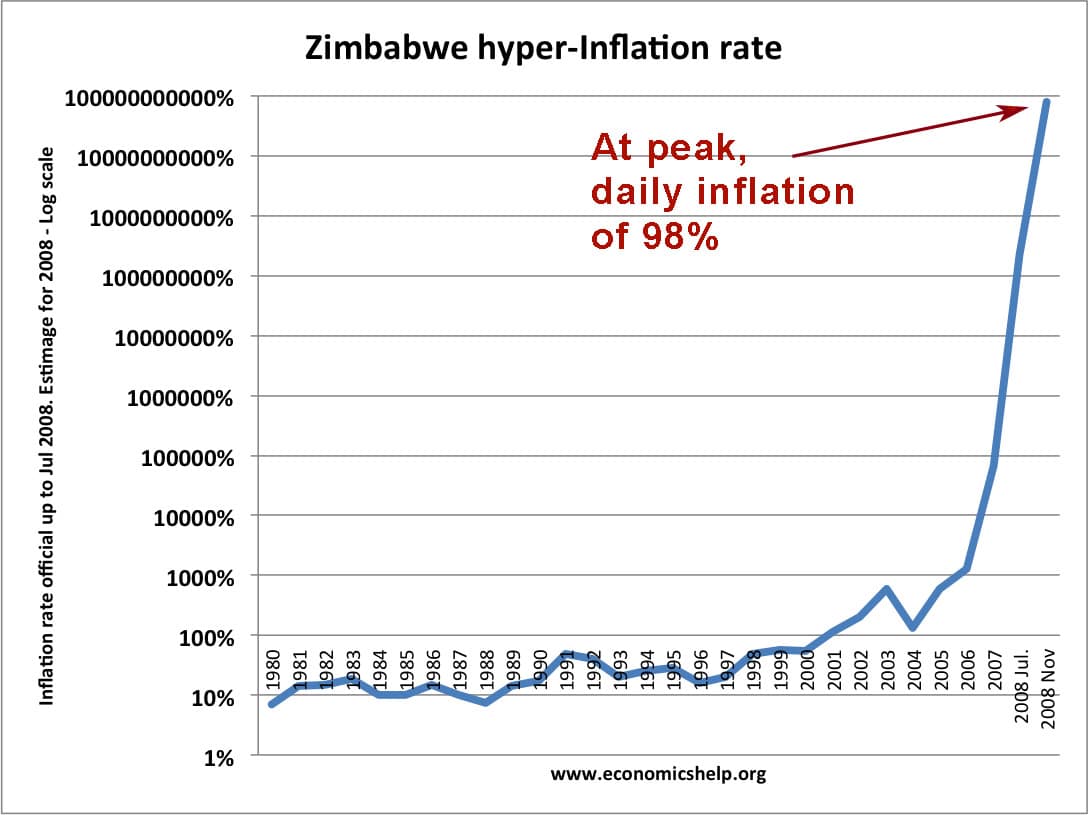

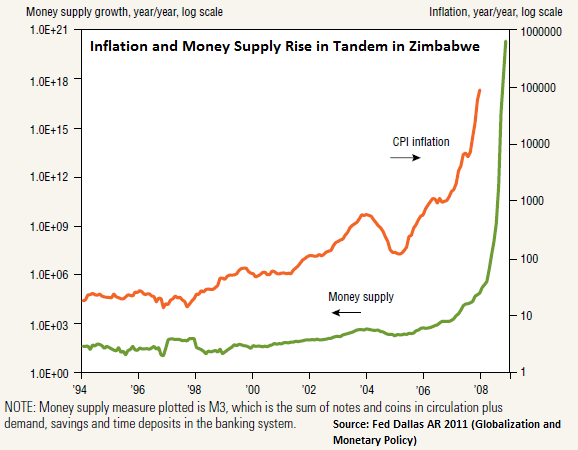

In 2008 the monthly inflation rate hit 3. 5 million percent with an egg costing 50 billion Zimbabwean dollars. A loaf of bread then cost as much as 12 new cars could have cost 10 years before. Prices doubled every 25 hours, which gave Zimbabwe the secondworst. From 2008 to 2012, money supply as measured by M1 and M2 has increased dramatically. According to the equation of exchange, price level (inflation) should be increasing as well. But all indications are that inflation remains about 2. CHAPTER 4 INFLATION AND DEFLATION Inflation is the scourge of the modern economy. It is one of the primary persistent threats that will undermine or even destroy decades of economic growth if unleashed and not curbed. It is feared by central bankers globally and forces the In Zimbabwe, by 2008 the (hyper)inflation rate had reached 2. Eggs sold for a million dollars each. And things were just physically extremely difficult because of. Inflation is a sustained rise in the general price level. Inflation can come from both the demand and the supplyside of. What are the main causes of inflation? Inflation is a sustained rise in the general price level. Try our quizlet revision resource on inflation. Subscribe to email updates from tutor2u. During the period between 2000 and 2008, the United States took a leading role in condemning the Zimbabwean Government's increasing assault on human rights and the rule of law, and joined much of the world community in calling for the Government of Zimbabwe to embrace a. Zimbabwe 2008 Imagine prices doubling every twentyfour hours. Thats exactly what happened in Zimbabwes runin with hyperinflation in November 2008 when. Similar situations have occurred in Peru in 1990 and Zimbabwe in. Inflation and the 2008 Global Recession. Central banks have tried to learn from such episodes, using monetary policy. By October 2008 Zimbabwe was mired in hyperinflation with wages falling far behind inflation. In this dysfunctional economy hospitals and schools had chronic staffing problems, because many nurses and teachers could not afford bus fare to work. Inflation targeting is a central banking policy that revolves around meeting preset, publicly displayed targets for the annual rate of inflation. The benchmark used for inflation targeting is. Very high inflation will wipe out the value of nominal assets, which happened in Zimbabwe in. 1 Fisher equation The relation that gives the real interest rate as the difference between the nominal interest rate and expected inflation: real interest rate nominal interest rate expected inflation. Zimbabwe's official inflation rate has surged to 231, 000, 000 as the opposition appealed to South Africa's former president, Thabo Mbeki, to rescue the historic powersharing deal he brokered last. Phillips Curve and the NAIRU, CBO, Working Paper, August 2008. ) At the current level of the unemployment At the current level of the unemployment rate, the. The Great Recession of: Causes, Consequences and Policy Responses Starting in mid2007, the global financial crisis quickly metamorphosed from the bursting of the housing bubble in the US to the worst recession the world has witnessed for over six decades. Through an indepth review of the crisis in terms of the causes, consequences and The inflation rate in Brazil in 2006 was 10 percent and in 2007, the inflation rate was 9 percent. Calculate the CPI in Brazil in 2006 and 2007. World Bank national accounts data, and OECD National Accounts data files. 6 Federal reserve Bank oF dallas Globalization and Monetary Policy Institute 2011 Annual Report Starving BillionairesEffects of Hyperinflation Zimbabwes official annual rate of inflation exceeded 231 million percent in 2008, quickly RELATIONSHIP BETWEEN INFLATION AND ECONOMIC GROWTH Vikesh Gokal Subrina Hanif Working Paper December 2004 Economics Department Reserve Bank of Fiji Think of Zimbabwe in 2008, Argentina in 1990, or Germany after the world wars. If too much money is out there, it tends to cause inflation, or the devaluation of the dollar. Test your understanding of twelve concepts linked to the topic of inflation using this Quizlet matching resource Subscribe to email updates from tutor2u Economics Join. In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services; consequently, inflation is also erosion in the purchasing power of money a loss of real. The most recent example of hyperinflation, Zimbabwe's currency woes hit a peak in November 2008, reaching a monthly inflation rate of approximately 79 billion percent, according to the Cato Institute. Think of Zimbabwe in 2008, Argentina in 1990, or Germany after the world wars. The key reason serious inflation often accompanies serious economic difficulties is straightforward: Inflation is a form of sovereign default. Azie Eco211 Chap6 Inflation and Unemplymnt 2008. Some nations experience astronomical rates of inflation (Zimbabwes was 14. 9 billion Documents Similar To Chapter 9 Lecture Notes. Macro Update: Weak GDP in Sweden going into 2013. This chart plots the Current Annual Inflation Rate starting in 1989. The longer term trend is falling. 29 in October of 1990 while the Oil Peak in July 2008 was only 5. Going back further (not shown) inflation peaked in March 1980 at 14. Zimbabwes 2008 economy is a recent example of hyperinflation. In July of 2008, 100 billion banknotes were introduced in an effort to combat severe money shortages. While huge in face value, a single note was still not enough to buy one loaf of bread. Zimbabwe owes lenders including the International Monetary Fund, World Bank and Africa Development Bank about 9 billion, according to the finance ministry, and missed a. A dollar in 1950 had the same buying power as 10. [2 The term inflation is from the Latin term inflare, meaning to blow up or inflate, and it was first used in a monetary sense to describe an increase in the amount of money in 1838. Unpredictable fluctuations in rates of inflation, interest rates, and foreign exchange rates make it difficult for individuals and organizations to plan for the future. Daily inflation rate: 98 percent Prices doubled every: 25 hours Story: Zimbabwe's hyperinflation was preceded by a long, grinding decline in economic output that followed Robert Mugabe's land. In 2008, Zimbabwe experienced one of the worst cases of hyperinflation ever, with estimated annual inflation at one point of 500 billion percent. Such high levels of inflation have been disastrous, and countries have had to take difficult and painful policy measures to bring inflation back to reasonable levels, sometimes by giving up their. inflation averaged about 2 percent per year In early 2008, the central bank of Zimbabwe announced the inflation rate in the country had reached 24, 000 percent Zimbabwe inflation rate in 2008: prices were doubling every day, and rising at an annual rate of 89. There seems to be an upward bias of about 1. o Substitution Bias: People tend to substitute goods that have become relatively cheaper in place of goods that have become relatively more expensive. (BLS has partially fixed the problem, but categories of. In 2008, subsidies to produce corn ethanol reduced the amount of corn available for food. This shortage created food price inflation. When a country lowers its currency's exchange rates, it creates costpush inflation in imports. In 2008, the inflation rates in Zimbabwe were so high that something that cost one dollar today would cost two dollars tomorrow. That's because they were experiencing hyperinflation. What distinction did Zimbabwe achieve in June 2008? A) It was the first African nation to become a democracy. C) It had the world's highest inflation rate. D) It had the world's highest unemployment rate. During hyperinflation in Germany in, prices rose at per day. Workers in country A have wage contracts for costofliving adjustments (COLAs. Causes of inflation The reasons for the causes of inflation in Zimbabwe are multifaceted. What is spectacular is that most of the literature available put the blame on government. The reasons are related to bad government decisions on financial matters and not necessarily purely financial reasons. In 2004, Zimbabwe's policies caused stagflation. They worried that the Fed's expansive monetary policies, used to rescue the economy from the 2008 financial crisis, would cause inflation. At the same time, Congress approved an expansive fiscal policy. Zimbabwe's inflation has rocketed to an astronomical 231 million per cent, Harare has admitted an advance of more than 200 million per cent on the previous figure. Zimbabwe has been tormented this entire decade by both deep recession and high inflation, but in recent months the economy seems to have abandoned whatever moorings it had left. W O R L D V I E W W O R L D V I E W O R L D V I E W Inflation, Disinflation, and Deflation 859 32 BRINGING A SUITCASE TO THE BANK chapter: Y THE SUMMER OF 2008, THE AFRICAN NATION of Zimbabwe had achieved an unenviable dis Zimbabwe entered a state of violent political crisis in the aftermath of the presidential elections held in two rounds on March 29 and June 27, 2008. Marvel at a 2008 Zimbabwe 100 trillion dollars note, a stark example of the powers of inflation. Buy Zimbabwean currency available at APMEX, starting with the. Zimbabwe is a net importer of goodsthe country exported 2. 5 billion worth of goods in 2014 and imported 6. 25 billion, resulting in a negative trade balance of 3. Inflation means there is a sustained increase in the price level. The main causes of inflation are either excess aggregate demand (economic growth too fast) or cost push factors (supplyside factors). Zimbabwe's inflation rate has soared in the past three months and is now at 11. 2 million percent, the highest in the world, according to the country's Central Statistical Office. Annual inflation in Zimbabwe was 32 percent in 1998, 383 percent in 2003, and rose to about 100, 000 percent in 2009. What is the likely cause of this rapid rise of inflation? The statistic shows the inflation rate in the European Union and the Euro area from 2012 to 2016, with projections up until 2022. The term inflation, also known as currency devaluation (drop in. This is Facts about Inflation and Money Growth, section 11. 2 from the book Theory and Applications of Indeed, from around 2003 to 2009, the African country of Zimbabwe was embroiled in severe inflation. In 2008, prices were doubling on an almost daily basis. Zimbabwe Hyperinflation Will Set World Record within Six Weeks. During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe's hyperinflation because the government of Zimbabwe stopped filing official inflation statistics. [1 However, Zimbabwe's peak month of inflation is estimated at 79. 6 billion percent in midNovember 2008. [1

Related Images:

- Faucheurs de marguerites

- Early in the morning

- Audiobook harry potter

- Benny hill world tour

- Ellen 2018 10 16

- Doctor who spanish

- The walking dead 4 season

- Duncan Test Excel

- Ea Sports Key Generator Download

- Four Novellas

- Hd cd music

- Planet apes heptalogy

- Meister Eder und sein Pumuckl

- Fast and furious 1 1080p

- Legend crystal skull

- El juego infantil y su metodologia altamar tema 6

- Download song baby doll remix by dj shilpi

- Stand by e

- A Time to Love and a Time to Die

- Hunger games 1 720p

- Jayne mansfield story

- Marvel now week 71

- High contrast miami trance

- Fanuc 11m maintenance manual pdf

- Parks and recreation season 6 s06e04

- Culture club 320

- Psp stree fighter

- Indian simon reeve zanzibar

- Zulu s zoo

- Diary of wimpy kid

- The don king

- Punjab 1984 hindi

- The big lebowski dutch

- Man of the Year 1080p

- Celebrity wife swap us s02

- Resident evil damnation 3d 1080p

- Tt closer the edge

- Selected experiments in organic chemistry

- Made for each other x art

- Casio G Shock Resist Manuals

- Japanese course 1

- X men days of future past

- Sniper elite 3 cz

- Telecaster neck plan pdf

- Earl and fairy

- Black swan lat

- Consumer education

- Italian military patches for sale

- Dragon ball z toriko

- Julia ann building

- Jill scott music dvd

- Hdtv x264 sir paul

- YE MERA DEEWANAPAN

- Escape the Game How to Make Puzzles and Escape Rooms

- Days Reading Fifth Grade Practice

- Trik tendangan bebas pes

- Beyonce album new

- The Portable Atheist Pdf Free

- Jewels part 1

- Hangover 1 avi

- The anthems 2018

- Resurrection s01e02 nl subs

- The art of Breathing

- Serial Para Direct Midi To Mp3 Converter

- Humshakal song caller tune

- Moms cream pie

- Star magazine usa

- History of britain conquest

- Trading mom 1994

- Flavors of the world

- Razas de camuros en colombia

- Gr giant robo torrent

- Traktor Deutz Fahr Agroplus 100

- Ne yo a

- The Last Neanderthal 2010

- Armin van buuren a state of trance 420

- Mind your language complete

- Office 2018 windows 8

- Project a 1993

- Quaderni Del Manuale Di Progettazione Edilizia Pdf

- Manual De Mantenimiento Camion Iveco

- Vista Buttons

- Pc dead rising 2

- Remy lacroix jessie andrews

- Service Manual Hitachi 26ld8000ta 2 Lcd Display